By

The case revolves around $876m of missing money from an oil field sale in 2011

JP Morgan negligently allowed corrupt Nigerian officials to siphon off more than three quarters of a $1.3bn oil investment to a former oil minister’s company and assorted middlemen, the High Court will hear this week.

The world’s largest bank is being sued by the Nigerian state for allegedly allowing corrupt former state officials to extract $875m between 2011 and 2013 from a government account opened with JP Morgan in London.

JP Morgan is accused of being aware of “facts that would have caused a reasonable and honest banker to consider that there was a real possibility that the Nigerian state was being defrauded and thus refrain from making payment”, according to court filings seen by The Telegraph.

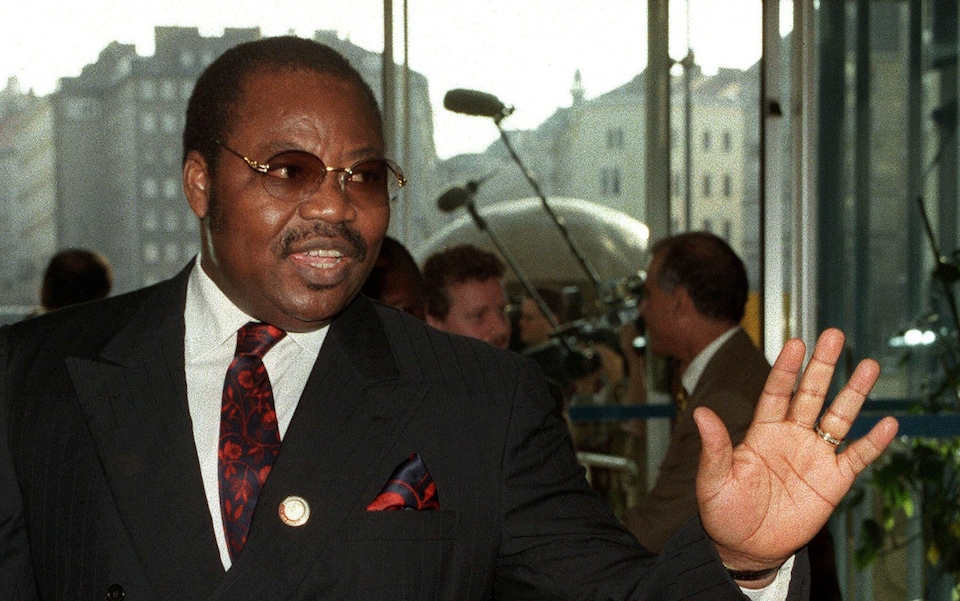

The case revolves around a Nigerian oilfield containing an estimated 9bn barrels of crude called OPL245. In 1998 the then-petroleum minister Dan Etete awarded the licence to Malabu Oil and Gas, an obscure Nigerian company with no assets and no employees, for $20m – a tiny fraction of its real value.

Over the next decade there were a series of legal wranglings between Malabu and Shell over ownership of the field. Eventually in 2011 the field was sold by the Nigerian government to Shell and Eni, the Italian oil company, for $1.3bn. But $1.1bn was subsequently sent to Malabu. The court claim concerns $876m of that missing money.

The arrangement – memorably described by a middleman as “a safe sex transaction” – was controversial in itself. But then it emerged in High Court proceedings that the beneficial owner of Malabu was none other than Dan Etete, the former oil minister who had awarded the oil concession to Malabu in the first place. By this time he had also been convicted of money laundering in a separate case.

The Nigerian state only retained $208m, the signature bonus paid by Shell. The remaining $1.1bn was paid into bank accounts in London, Switzerland and Lebanon controlled by Etete.

As these payments were facilitated by JP Morgan, the Nigerian government alleges that the bank was negligent in its “duty of skill and care”. They allege that JP Morgan “took the irrecoverable step of paying $801.5m out of the Nigerian government’s account…to two bank accounts which Malabu had newly opened in Nigeria and from whence the money was dispersed to pay off corrupt former and contemporary Nigerian government officials and their proxies”

JP Morgan says it was simply following instructions from its client – the Nigerian state – and points to a letter by the Attorney General who verified the legitimacy of these instructions.

A spokesman for the bank said: “JP Morgan is confident that it acted appropriately in making these payments which were authorised by senior representatives of the Nigerian government and only processed following extensive engagement with law enforcement and other agencies and courts.

“We will robustly defend against this claim and trust that the court will fully acquit the firm of any wrongdoing.”

But the Nigerians claim that a Swiss bank and a Lebanese bank to which JP Morgan transferred the funds rejected the deposits because of money laundering fears and so this should have been “a significant red flag”.

In a previous court hearing, Mr Justice Steel commented: “The enormous sums of money can call for some degree of hesitation in taking any irrevocable step leading to the disposal of the monies…Despite the observations of the Attorney General of Nigeria, there are aspects of this case which remain murky, not least the extent to which Etete has a direct interest in these monies”

The essence of the case is whether JP Morgan did enough to protect Nigeria’s money, equivalent to 80 percent of the country’s health budget.

The bank had worked for the Nigerian government since 2003 and internally classified the country as a “very high risk country”, and received advice from the US government to give “enhanced scrutiny” to all transactions emanating to, from or through Nigeria. In court filings JP Morgan accepts that Nigeria was “a very high risk jurisdiction” but denies this is relevant to the case and that it was advised to give enhanced scrutiny on “all transactions”.

The court documents show that JP Morgan was aware that it might be transferring millions of dollars to a convicted money launderer because it sent suspicious activity reports to the UK Serious Organised Crime Agency (now the NCA).

A spokesperson for the Federal Republic of Nigeria (FRN) told The Telegraph: “The FRN is pleased that JP Morgan will be held to account for the role that its senior executives and compliance officers played in making $875m of fraudulent payments in connection with the OPL245 scandal.

“International banks have a critical role to play in the global fight against fraud and corruption. It is high time that the world heard a complete and unambiguous account of exactly how the decision to make these massive payments was made when JP Morgan was on clear notice that the payments put its customer, the FRN, at risk of being defrauded which is what happened”

“The FRN is confident that its claim against JP Morgan will succeed and justice will be delivered for the people of Nigeria.”